Good morning folks!

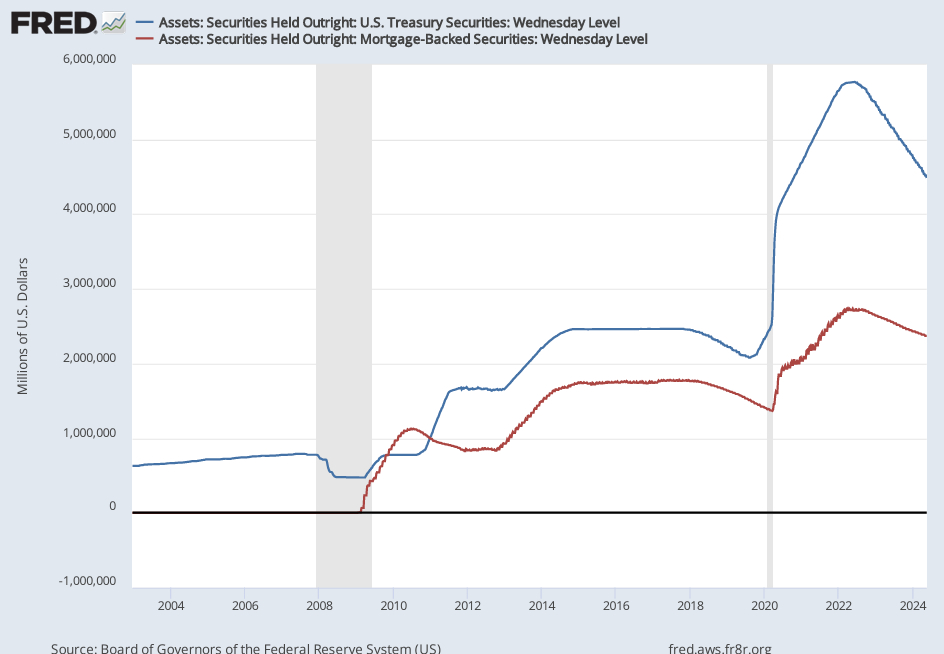

It's a beautiful Friday, and you know what that means – the Fed's weekly balance sheet updates are here. And guess what? The quantitative tightening (QT) train keeps chugging along. This week, the Fed mainly slashed its Treasury holdings, with less than a billion shaved off those pesky mortgage-backed securities (MBS).

Let's break it down. Over the past year, Treasury holdings have taken a serious haircut, dropping from a hefty $5.19 trillion to $4.49 trillion. That's a solid 14.6% cut. The MBS, however, are moving at a snail's pace, down from $2.57 trillion to $2.37 trillion. Why so slow? Blame the real estate freeze. Homeowners are clinging to their golden 2% mortgages, waiting for the storm to pass.

Overall, this week saw a total reduction of $49.1 billion, contributing to a massive $1.15 trillion shed over the past year. Looking ahead, the Fed's planning to ease up on the QT throttle. Their strategy? Slow and steady wins the race. By dialing down the pace, they aim to trim the balance sheet more effectively in the long haul.

So, keep your eyes peeled, folks. The Fed's QT journey is far from over, and there are sure to be more twists and turns ahead.

Happy investing!